Bitcoin is unique among financial assets because it has a built-in scarcity mechanism known as the halving. Unlike fiat currencies, which can be printed at will by governments or central banks, Bitcoin has a predictable supply schedule. Every four years—or approximately every 210,000 blocks mined—the reward for miners is halved, reducing the number of new coins entering circulation. This event, known simply as the Bitcoin halving, is one of the most important drivers of long-term price trends and market psychology.

Understanding the halving is crucial for anyone serious about Bitcoin investing. It explains historical bull cycles, affects miner behavior, and demonstrates why Bitcoin’s scarcity is fundamentally different from traditional financial assets. This article dives deep into the mechanics of the halving, its economic implications, historical impact on price, and strategies investors can use to benefit from this predictable supply shock.

What is the Bitcoin Halving?

The Bitcoin network relies on miners to validate transactions and secure the blockchain. Miners receive newly minted Bitcoin as a reward for their work, a process known as mining. Originally, each block mined rewarded 50 BTC. Approximately every four years, this reward is cut in half:

- 2012 Halving: 50 BTC → 25 BTC

- 2016 Halving: 25 BTC → 12.5 BTC

- 2020 Halving: 12.5 BTC → 6.25 BTC

- Expected 2024 Halving: 6.25 BTC → 3.125 BTC

The halving reduces the rate of new supply entering the market, creating a deflationary pressure as demand continues or grows. This scarcity is algorithmically guaranteed, unlike fiat currencies, which can be printed in unlimited amounts based on policy decisions.

Economic Implications of the Halving

The halving has several economic effects:

- Supply Reduction: Fewer new coins enter circulation, decreasing selling pressure from miners who need to cover operational costs.

- Price Expectation: Investors anticipate scarcity, which can drive demand in the months leading up to and following the halving.

- Market Psychology: Media coverage and public awareness spike during halving events, increasing retail participation.

- Miner Economics: Mining becomes less profitable per coin, forcing less efficient miners out of the network and strengthening overall security and decentralization.

It’s important to note that the halving does not guarantee instant price increases. Markets are complex, and immediate reactions can vary. Historically, however, halvings have preceded extended bull markets, often over months or years rather than days.

Historical Price Trends

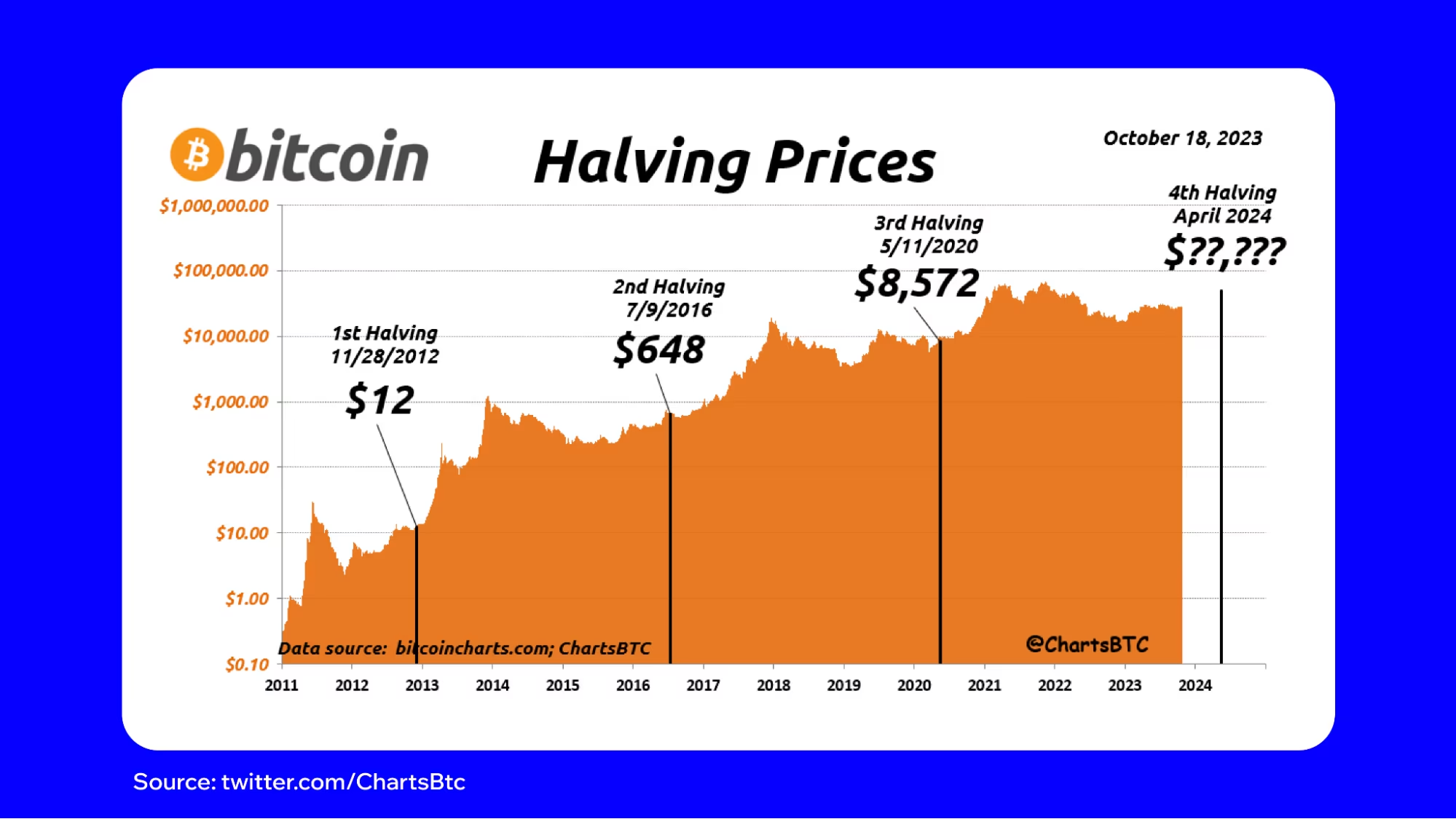

Bitcoin halvings have historically correlated with significant long-term price growth:

- 2012 Halving: Bitcoin rose from under $12 to over $1,100 in the subsequent year, demonstrating early market recognition of scarcity.

- 2016 Halving: Bitcoin climbed from around $650 to nearly $20,000 by late 2017, fueled by institutional attention and increasing adoption.

- 2020 Halving: Bitcoin started around $8,700 and surged past $64,000 by April 2021, driven by macroeconomic stimulus and growing institutional investment.

These examples show a clear pattern: supply shocks combined with growing demand create bullish narratives. Even if the price does not immediately reflect scarcity, long-term accumulation strategies can capitalize on the eventual market response.

Why the Halving Matters for Long-Term Investors

Understanding the halving allows investors to adopt a strategic approach rather than reactive trading. The predictable reduction in supply provides a framework for accumulation:

- Pre-Halving Accumulation: Buying before the halving can position investors for potential gains in the following cycle.

- Post-Halving Patience: Holding through the months after the halving often allows scarcity effects and market recognition to manifest.

- Fundamental Analysis: Investors can monitor miner behavior, network activity, and adoption trends to make informed decisions.

The halving also reinforces Bitcoin’s status as a deflationary asset, distinguishing it from fiat currencies and other commodities. Unlike gold, which can be mined in increasing quantities, Bitcoin’s issuance is mathematically fixed, providing certainty that cannot be overridden by political or institutional intervention.

Miner Behavior and Network Security

Miners are integral to Bitcoin’s ecosystem. During halving events, the reduction in rewards forces less efficient miners to upgrade equipment or exit the network. While some argue this could temporarily weaken network security, historically, the network has remained robust. Efficient miners continue operations, maintaining decentralization and validating transactions.

Additionally, scarcity created by the halving can increase the perceived value of the coins miners hold, which in turn influences long-term market supply as miners may delay selling until higher prices are realized. This dynamic contributes to market stability over time.

Strategic Insights for Investors

While the halving itself is deterministic, market reactions can vary. Investors should consider:

- Dollar-Cost Averaging (DCA): Accumulating Bitcoin steadily before and after halving events reduces timing risk.

- Long-Term Holding: Halvings are most impactful over months and years, not days. Patience is crucial.

- Macro Awareness: Inflationary pressures, global stimulus, and adoption trends influence halving effects on price.

- Network Metrics: On-chain data like miner reserves, wallet activity, and transaction volumes can signal future market movements.

By aligning investment strategy with halving cycles, investors position themselves to benefit from Bitcoin’s predictable scarcity while mitigating short-term volatility risks.

Halving and Bitcoin’s Deflationary Nature

Unlike fiat money, which central banks can expand indefinitely, Bitcoin’s halving ensures that its monetary policy is immutable and predictable. Each halving strengthens the argument for Bitcoin as “digital gold,” a store of value that cannot be debased by arbitrary policy decisions. This deflationary model underpins Bitcoin’s long-term value proposition and makes it increasingly attractive to institutional investors seeking protection against inflation.

Psychological and Market Effects

Halvings have a psychological impact far beyond the mechanics of supply reduction. Media coverage intensifies, social narratives around scarcity amplify, and investor sentiment becomes more bullish. Retail investors often enter the market in anticipation of post-halving gains, while institutions monitor fundamentals to optimize portfolio allocation. The combination of scarcity, narrative, and strategic accumulation creates a unique dynamic not seen in traditional assets.

Conclusion

The Bitcoin halving is more than a technical event—it is a cornerstone of Bitcoin’s economic model. By reducing new supply, it enforces scarcity, encourages strategic accumulation, and influences market psychology. Historical trends demonstrate that halvings often precede long-term bull markets, although immediate price effects can be unpredictable.

For long-term investors, understanding the halving is essential. It provides a framework for accumulation, insight into miner behavior, and a lens through which to view Bitcoin’s deflationary design. Unlike fiat currencies or even traditional commodities, Bitcoin’s supply schedule is fixed and predictable, making the halving a unique and powerful force in global finance.