Bitcoin has faced one of its most dramatic downturns in recent years, shaking investor confidence, testing adoption momentum, and challenging the narrative of digital gold. As 2026 unfolds, the cryptocurrency market is emerging from this deep correction, raising critical questions: How will Bitcoin recover? What innovations will shape its utility? And what does this mean for investors, institutions, and global financial systems? Understanding Bitcoin’s trajectory in 2026 requires analyzing macroeconomic trends, adoption patterns, technological advances, and investor psychology in a post-crash environment.

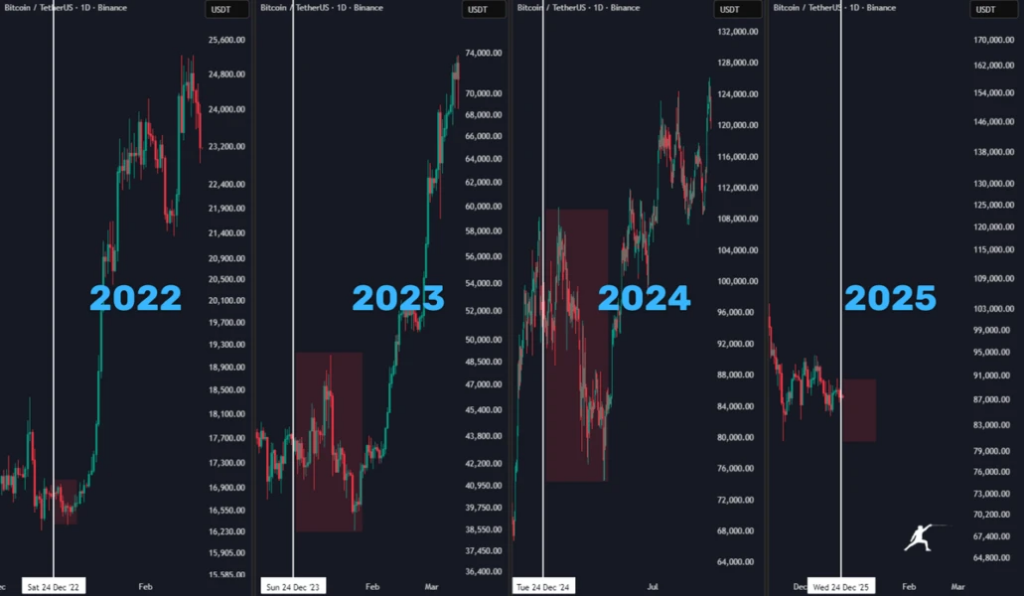

While the 2025 downturn exposed vulnerabilities in leverage, market speculation, and regulatory uncertainty, it also highlighted Bitcoin’s resilience and the structural strength of its decentralized network. Historically, Bitcoin has experienced cyclical highs and lows, and the aftermath of major corrections often precedes periods of innovation, adoption, and long-term growth.

Market Dynamics Post-Crash

The major decline leading into 2026 has reshaped Bitcoin’s market landscape:

- Investor Sentiment: Retail investors initially panicked, but long-term holders (“HODLers”) reinforced confidence, creating a stabilizing effect.

- Institutional Positioning: Institutions with diversified strategies continued accumulating during the downturn, reinforcing Bitcoin’s credibility as a store of value.

- Liquidity Shifts: Exchanges saw consolidation of liquidity, with lower volumes but higher quality trades as speculative noise decreased.

The post-crash environment has created a foundation for sustainable growth, where market activity is guided more by fundamentals than speculative frenzy. This stabilization is critical for both retail and institutional confidence in 2026.

Bitcoin Adoption Trends in 2026

Despite the crash, adoption continues to grow globally:

- Corporate Treasuries

Some forward-thinking corporations are adding Bitcoin to their balance sheets, capitalizing on lower prices and anticipating future appreciation. Companies are using this period to diversify treasury reserves and hedge against macroeconomic instability. - Emerging Markets

Bitcoin remains an attractive alternative in countries with currency instability, high inflation, or restricted banking access. Mobile wallets and Layer-2 integrations enable microtransactions, remittances, and everyday commerce. - Institutional Products

ETFs, futures, and custody solutions are expanding access, allowing professional investors to participate securely. This trend fosters liquidity, transparency, and market maturity.

Adoption is being driven by both practical use cases and renewed investor confidence as prices stabilize, demonstrating that Bitcoin’s resilience extends beyond speculative cycles.

Technological Advancements Driving Recovery

Bitcoin’s 2026 recovery is closely tied to innovation in its ecosystem:

- Layer-2 and Lightning Network Expansion: These networks facilitate faster, cheaper transactions, making Bitcoin practical for retail and institutional payments.

- Cross-Chain DeFi Integration: Interoperability protocols allow Bitcoin to participate in lending, borrowing, and tokenization on other chains, increasing its utility and liquidity.

- Privacy Enhancements: Advances in privacy-preserving protocols allow users to transact securely, balancing transparency with confidentiality.

- Sustainable Mining: Renewable energy adoption and improved ASIC efficiency reduce environmental criticisms, increasing mainstream legitimacy.

Technological innovation ensures that even after a severe crash, Bitcoin remains a relevant, secure, and adaptable network.

Investor Strategies for 2026

Investors entering the post-crash environment are taking more nuanced approaches:

- Long-Term Accumulation: Smart money focuses on dollar-cost averaging, capitalizing on lower prices and market consolidation.

- Risk Management: Diversified portfolios, combining Bitcoin with stablecoins, fiat, and traditional assets, mitigate volatility exposure.

- Participation in Layer-2 and DeFi: Investors increasingly leverage Bitcoin for yield generation, lending, and cross-chain opportunities.

These strategies reflect a more mature market, where decision-making is informed by fundamentals, network adoption, and technological developments rather than hype cycles.

Regulatory Developments Shaping 2026

The post-crash era has prompted governments and regulators to refine their approach:

- Clearer Guidelines for Institutions: Regulated custody, tax reporting, and compliance frameworks encourage institutional adoption.

- Balanced Oversight: Regulators aim to prevent illicit use while supporting innovation, increasing confidence among mainstream investors.

- Global Coordination: International standards for taxation, reporting, and DeFi integration are emerging, facilitating cross-border Bitcoin transactions.

Regulatory clarity strengthens Bitcoin’s role as a legitimate, long-term financial asset, reducing systemic risks while promoting adoption.

Potential Scenarios for Bitcoin in 2026

Analysts envision several paths for Bitcoin post-crash:

- Moderate Recovery and Consolidation

Prices stabilize, adoption grows steadily, and innovation continues, creating a sustainable growth environment. - Aggressive Institutional Accumulation

Lower prices incentivize corporations and funds to increase exposure, potentially driving a rapid appreciation phase. - Macro-Driven Volatility

Economic instability, inflation, or interest rate shifts could introduce short-term volatility, but long-term adoption trends and Layer-2 utility mitigate systemic risk.

While no scenario guarantees specific outcomes, Bitcoin’s structural fundamentals—decentralization, scarcity, and security—remain intact.

Broader Implications for the Cryptocurrency Ecosystem

Bitcoin’s trajectory in 2026 will also influence other cryptocurrencies and the broader digital asset landscape:

- Market Leadership: Bitcoin continues to serve as a reference asset, shaping investor sentiment across crypto markets.

- DeFi Growth: Layer-3 and interoperability protocols enable Bitcoin to integrate with Ethereum, Solana, and other ecosystems.

- Innovation Spillover: Advances in privacy, security, and scalability driven by Bitcoin benefit other blockchain projects, reinforcing the overall ecosystem.

The post-crash recovery positions Bitcoin not only as a store of value but also as a catalyst for innovation in the decentralized financial world.

Investor and Public Takeaways

For individuals, institutions, and enthusiasts:

- Resilience Matters: Bitcoin’s recovery underscores the network’s ability to withstand extreme market stress.

- Innovation Drives Value: Technological progress in Layer-2, privacy, and cross-chain interoperability is critical for adoption and utility.

- Strategic Patience: Post-crash periods reward disciplined, long-term accumulation and engagement with the ecosystem.

Understanding these lessons allows participants to navigate volatility while positioning themselves for future growth.

Final Thoughts

2026 marks a pivotal year for Bitcoin after a significant market downturn. While the crash highlighted vulnerabilities and tested investor confidence, it also created opportunities for technological adoption, institutional accumulation, and sustainable growth. The network’s resilience, combined with advancements in Layer-2, cross-chain DeFi, privacy, and renewable mining, positions Bitcoin for a robust recovery and long-term relevance.

Investors and institutions who approach this period strategically—focusing on fundamentals, adoption trends, and technological innovation—are likely to benefit from Bitcoin’s renewed potential. Meanwhile, global adoption, regulatory clarity, and interoperability ensure that Bitcoin’s impact extends far beyond price, solidifying its position as a secure, versatile, and transformative financial asset.

In 2026, Bitcoin is no longer just recovering from a crash—it is laying the foundation for its next era: a period defined by maturity, adoption, innovation, and resilience in the global financial system.